A dive into crypto for Family Offices

A dive into crypto for Family Offices

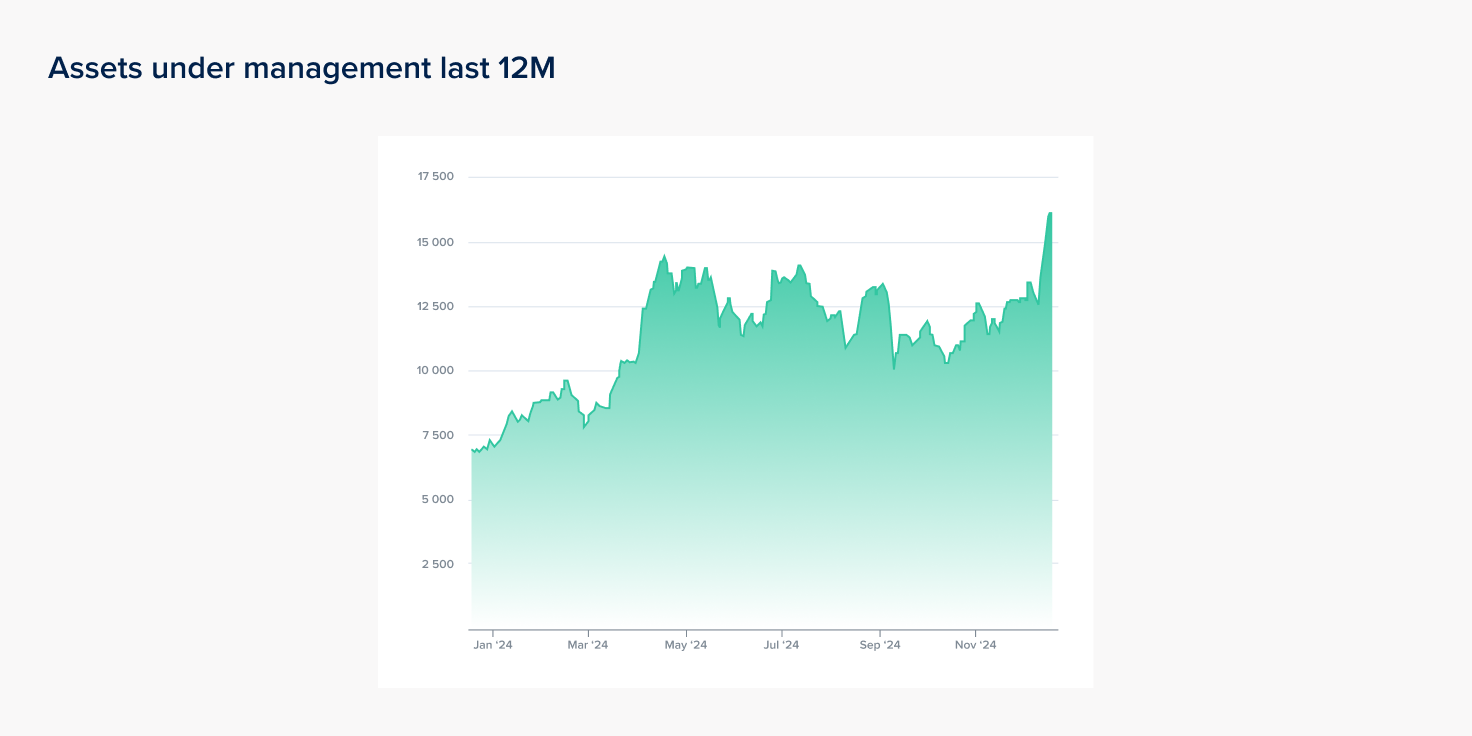

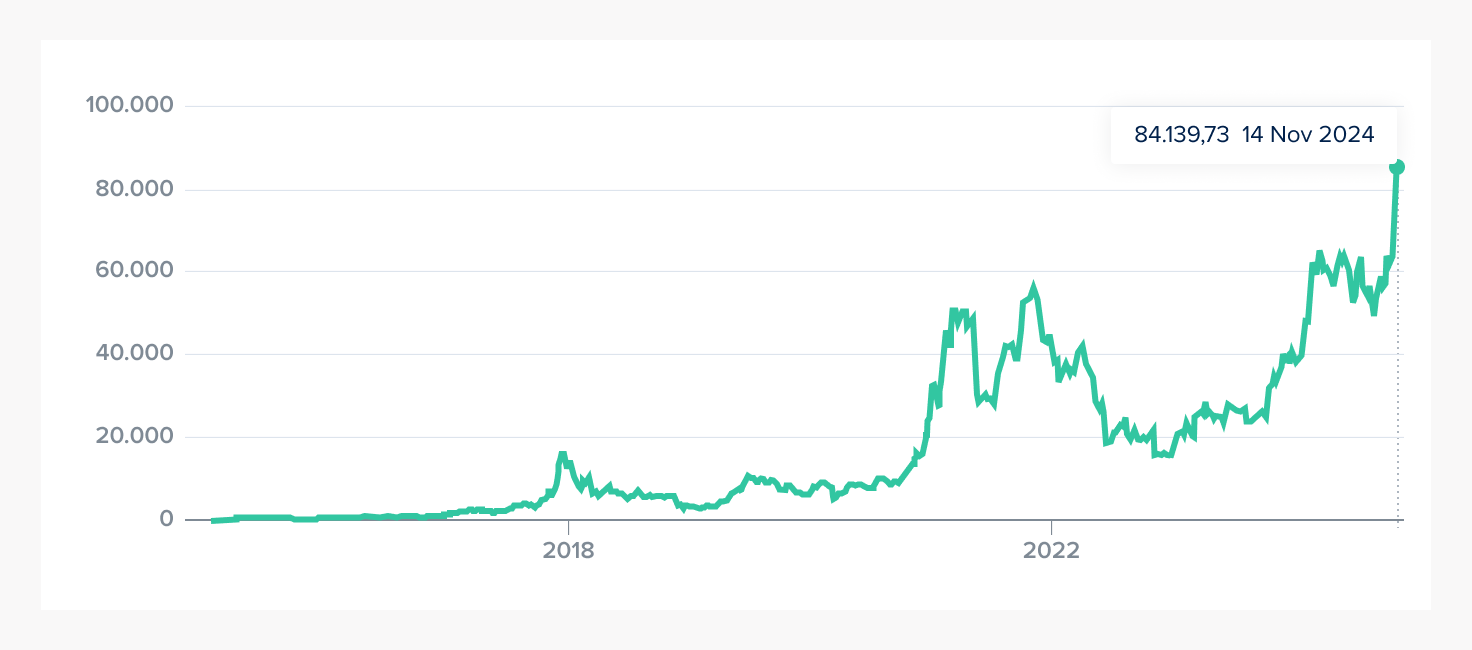

The allure of cryptocurrencies, with their potential for high returns and portfolio diversification, has led to a marked increase in adoption among family offices. According to recent industry reports, 17% of family offices are now “bullish” on cryptocurrency investments, a notable jump from just 8% last year (source). This surge reflects a growing recognition of the role of crypto in modern investment strategies. With crypto ETPs (exchange-traded products) inflows growing steadily over the year, institutional allocators in Europe are looking to gain exposure to this emerging asset class.

Current trends in Family Office crypto investments

1. Diversification strategy

Family offices are increasingly viewing cryptocurrencies as a key component of their portfolio diversification strategy, drawn by the distinctive advantages these digital assets offer. Cryptocurrencies, such as Bitcoin and Ethereum, have demonstrated a low correlation with traditional asset classes like equities, bonds, and real estate, making them an attractive hedge against market volatility. This unique characteristic allows family offices to reduce overall portfolio risk while potentially enhancing returns.

Moreover, the rapid maturation of the cryptocurrency market has provided family offices with access to a growing array of investment vehicles, including direct purchases, crypto funds, and blockchain-focused venture capital opportunities. The increased regulatory clarity and institutional-grade infrastructure, such as custodial solutions and trading platforms, have also alleviated earlier concerns about security and compliance, encouraging greater participation.

Additionally, many family offices are drawn to the transformative potential of blockchain technology underpinning cryptocurrencies. Beyond speculative returns, they recognize the role digital assets could play in the broader financial system, from decentralized finance (DeFi) innovations to tokenized real-world assets. This forward-looking perspective aligns with their long-term wealth preservation and growth objectives.

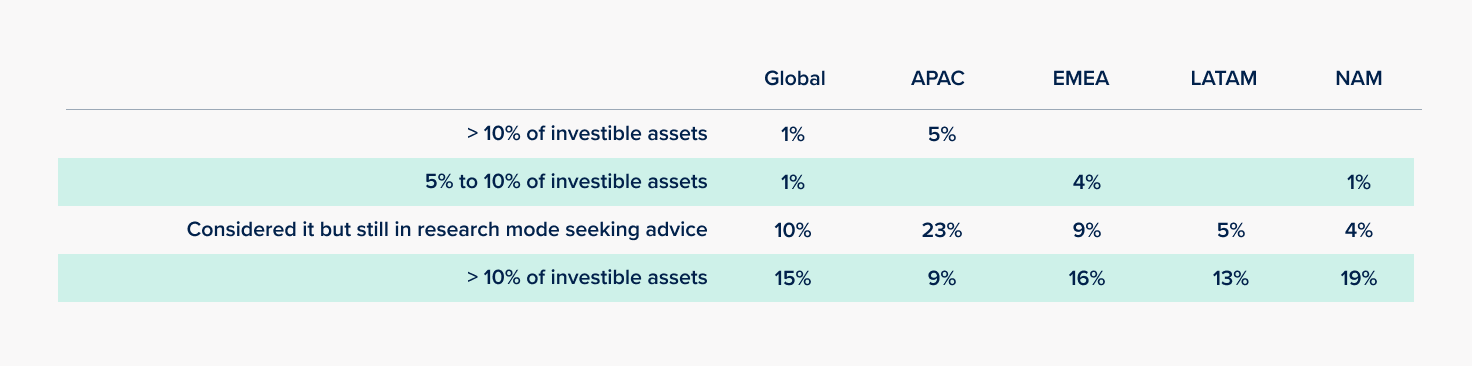

A 2023 survey conducted by Goldman Sachs (source) revealed that about 32% of family offices have incorporated digital assets into their investment portfolios. This represents a significant increase from 16% in 2021, despite the challenges posed by the bear market over the past two years. This shift highlights a growing recognition of cryptocurrencies as a viable asset class. However, it is noteworthy that many of these early adopters are approaching the market with prudence, with 15% of respondents allocating less than 5% of their total portfolios to digital assets (source). This conservative allocation reflects a cautious yet strategic engagement with the nascent sector, as family offices balance the potential for high returns with the inherent volatility and risks associated with the crypto space.

2. Direct exposure preference

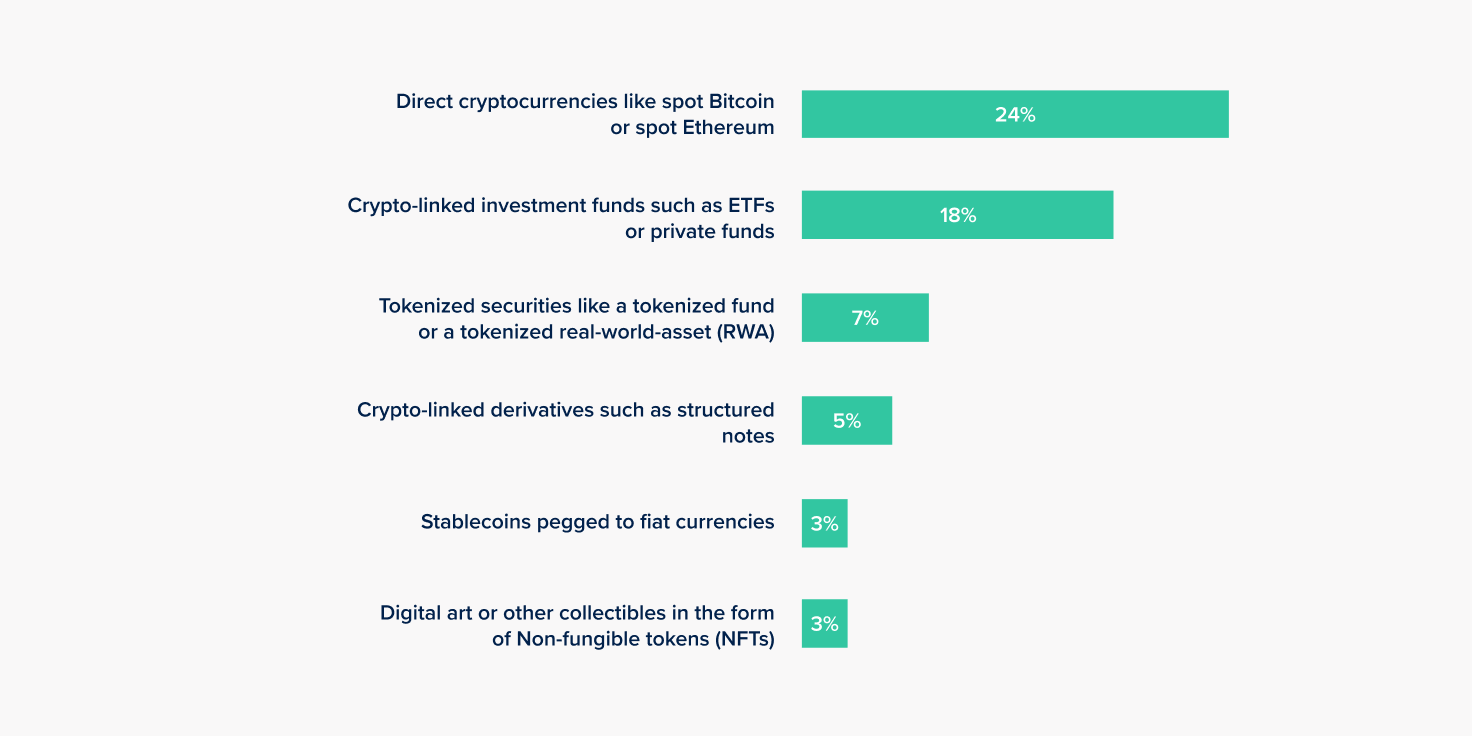

Family offices exhibit a distinct preference for direct exposure when investing in cryptocurrencies. According to the Citi Global Family Office 2024 Survey Report, 24% of surveyed family offices opt for direct investments in digital assets, compared to 18% who leverage exchange-traded funds (ETFs) and exchange-traded products (ETPs) for exposure. This inclination toward direct investment reflects their desire for enhanced control over their portfolios and the flexibility to tailor strategies to their specific goals.

Moreover, this approach highlights the unique risk tolerance of family offices, which are often better positioned than traditional institutional funds to embrace emerging technologies and less liquid markets. Their ability to act with agility and long-term vision enables them to navigate the complexities of digital assets while capitalizing on their potential for outsized returns. This strategic decision underscores a growing confidence in the transformative potential of cryptocurrencies within sophisticated wealth management frameworks.

3. Regional differences

The adoption of cryptocurrency investments by family offices demonstrates pronounced regional disparities. The Asia-Pacific region emerges as a frontrunner, with 37% of family offices either actively investing in or expressing interest in digital assets. This enthusiasm is underscored by the finding that one in twenty family offices in the region has allocated over 10% of their investable assets to digital assets, signaling a strong conviction in the growth potential of this emerging asset class.

In contrast, family offices in Latin America exhibit the lowest level of engagement, with 83% indicating that digital assets are not a strategic priority. Meanwhile, European family offices occupy a middle ground, with 28% reporting active investments in cryptocurrencies, as highlighted in the European Family Office Report (source).

These regional variations reflect differing levels of market maturity, regulatory clarity, and cultural attitudes toward innovation and risk. They underscore the nuanced ways in which family offices worldwide are navigating the opportunities and challenges posed by the burgeoning digital asset landscape.

4. Interest beyond cryptocurrency spot exposure

Family offices are not limiting their interest to just cryptocurrencies. There's a growing fascination with the broader blockchain ecosystem and its potential applications. This interest extends to areas such as decentralized finance (DeFi) and tokenized real-world assets (RWAs). Notably, large family offices show more interest in tokenized RWAs than smaller ones, with 11% of large entities reporting exposure compared to 3% for smaller ones. This trend highlights the family offices' forward-looking perspective and willingness to explore nascent technologies with long-term potential.

Investment strategies for Family Offices

As institutional investors, including family offices, navigate the cryptocurrency landscape, they are adopting diverse strategies to optimize returns while effectively managing risks. Here are three strategic approaches gaining traction among institutional players:

1. Buy & Hold

A foundational strategy in both traditional and digital markets, the "buy and hold" approach—popularized in the cryptocurrency space as HODLing (Hold On for Dear Life)—prioritizes long-term investment over short-term market timing. This method, rooted in simplicity and stability, aligns well with the extended investment horizons typical of institutions like family offices. Inspired by the principle behind Kenneth Fisher’s adage, "Time in the market beats timing the market," this strategy focuses on accruing value over time, leveraging the long-term growth potential of cryptocurrencies.

Institutions adopting this strategy often pair it with best-in-class custody solutions, such as those provided by Finoa, to ensure the highest levels of security for their digital assets. This combination of strategic patience and robust safeguards allows for consistent growth while mitigating operational risks.

2. Passive income

Beyond the traditional HODLing strategy, family offices are increasingly seeking ways to generate passive income from their cryptocurrency holdings. One popular method is staking, where digital assets are locked up to support blockchain network operations, earning passive income through annual percentage yields (APYs) typically ranging from 3% to 10%, depending on the network. In addition to providing consistent returns, staking can also fit family offices’ investment strategies, giving them a say in key decisions regarding the blockchain’s evolution.

Another avenue for passive income is yield farming, where family offices provide liquidity to decentralized finance (DeFi) protocols in exchange for rewards. Although yield farming can offer higher returns than staking, it comes with greater risks and operational complexity. To mitigate these risks, family offices should prioritize established, secure platforms which are known for their transparency and security. Effective risk management is critical in this space, and options such as platform diversification and DeFi insurance can help protect against vulnerabilities, including potential smart contract failures.

For institutional investors, direct participation in native staking offers a more attractive and potentially lucrative alternative to structured products like Exchange-Traded Products (ETPs) or Exchange-Traded Notes (ETNs), which may also include staking features. While these institutional products provide exposure to staking rewards, they typically retain a portion of the yields to cover management fees, ultimately reducing the returns for investors. By contrast, native staking enables family offices to capture the full spectrum of staking rewards, maximizing their potential returns while eliminating the intermediary costs tied to structured products. The only fees generally incurred are small charges paid to staking providers for their services.

For family offices seeking a secure and efficient staking solution, Finoa offers in-custody staking services, allowing clients to participate in native staking while benefiting from institutional-grade custody and robust security measures. This ensures a secure experience for family offices looking to optimize their crypto holdings for passive income generation.

3. Venture investments in the crypto ecosystem

Family offices are increasingly looking to venture investments as a key strategy for gaining exposure to the rapidly evolving crypto ecosystem. This includes early-stage investments in promising blockchain projects and emerging cryptocurrencies, equity stakes in crypto-centric companies, and participation in token sales for new ventures. These investments present the opportunity for exponential returns, mirroring the success of early backers in projects like Ethereum or Solana, who saw transformative growth as these platforms matured.

In addition to offering substantial financial upside, venture investments allow family offices to diversify their portfolios beyond direct cryptocurrency holdings. By participating in the broader blockchain ecosystem, they gain exposure to the technological innovation, scalability, and long-term growth potential that many believe will define the next generation of financial infrastructure.

Finoa, with its extensive experience working alongside crypto-native funds and blockchain projects, plays a pivotal role in supporting these investments from day one. We provide comprehensive services such as support for newly issued tokens, treasury management, and staking infrastructure, all designed to ensure the seamless management of venture investments. Notable examples of our day-one support include projects like Eigenlayer, Celestia, and more recently, Espresso Systems. These services are crafted to empower family offices and institutional investors, offering them the tools and expertise needed to effectively navigate and capitalize on the burgeoning crypto and blockchain space.

Future outlook

Increasing institutional adoption

The growing interest from family offices is part of a broader trend of institutional adoption. As more traditional financial institutions enter the crypto space in 2024, we can expect increased liquidity, stability, and legitimacy in the market going into 2025.

Regulatory clarity

The recent shift to a pro-crypto campaign by Donald Trump in the USA could transform the SEC's approach from a stringent enforcement stance to a more supportive environment that fosters growth and provides clear regulatory structures for the evolving cryptocurrency market. Trump's administration has promised to replace current SEC Chair Gary Gensler, known for his aggressive regulatory measures, with someone more favorable to the industry. This potential change could lead to a significant reduction in enforcement actions against crypto projects, allowing for innovation and investment to flourish. Additionally, Trump's proposals include establishing a dedicated White House position focused on cryptocurrency policy, with Cardanos Founder Charles Hoskinson already rumored to be part of.

In Europe, the Markets in Crypto-Assets (MiCA) regulation is set to play a pivotal role in shaping the cryptocurrency landscape. Adopted by the European Parliament in April 2023 and expected to come into full effect by December 2024, MiCA aims to create a harmonized regulatory framework across EU member states. This legislation will enhance consumer protection, establish clear rules for crypto-asset service providers, and introduce measures to prevent market abuse. By defining categories of crypto-assets—such as asset-referenced tokens and electronic money tokens—MiCA seeks to promote innovation while ensuring financial stability within the region (source).

In Asia, regulatory changes are also evolving rapidly, with countries like South Korea, Indonesia, and Thailand implementing frameworks that encourage innovation while ensuring compliance. South Korea's recent Virtual Asset User Protection Act enhances investor safeguards by mandating interest payments on deposits and tightening regulations against market manipulation (source). Hong Kong has established itself as the leader of the pack by rolling out robust regulation that can promote responsible innovation (source). Meanwhile, Indonesia has introduced a regulatory sandbox aimed at fostering blockchain innovation while maintaining oversight of digital assets. Thailand's Digital Asset Regulatory Sandbox allows businesses to test new services in a controlled environment, reflecting its commitment to advancing its crypto sector (source).

Technological advancements

The ongoing evolution of blockchain technology continues to expand beyond cryptocurrencies, presenting a diverse array of investment opportunities for family offices in 2024 and beyond. As the ecosystem matures, family offices are increasingly exploring innovative sectors within the blockchain space. Decentralized Finance (DeFi) platforms are attracting attention for their potential to revolutionize traditional financial services,while RWA) tokenization is gaining traction for its ability to bring liquidity to traditionally illiquid assets (source).

Emerging at the forefront of blockchain innovation are Decentralized Physical Infrastructure Networks (DePIN) and Decentralized Artificial Intelligence (DeAI) projects. DePIN initiatives, which leverage blockchain to decentralize physical hardware infrastructure, have seen significant investment activity, with fundraising volume increasing by 296% year-over-year (source). Similarly, DeAI projects, combining the power of artificial intelligence with blockchain's transparency and security, are opening new avenues for investment (source). The secutting-edge approaches can be appealing to family offices due to their potential for high growth and transformative impact across various industries.

Generational shift

As younger generations increasingly assume leadership roles within family offices, a marked shift towards more tech-savvy and forward-thinking investment strategies is anticipated. This transition is likely to foster a greater receptivity to digital assets and blockchain-based investments, reflecting a broader embrace of emerging technologies. These new decision-makers, more attuned to the digital landscape, are poised to drive innovation in portfolio diversification, positioning family offices to capitalize on the transformative potential of the crypto and blockchain sectors.

Integration with traditional finance

The convergence of traditional finance and cryptocurrency is accelerating, with innovative financial products bridging the gap between these two sectors. Blackrock's Buidl Fund exemplifies this trend, as major institutions explore blockchain integration to enhance existing products. Tokenized bonds are already gaining traction, with the U.S. treasury market on public blockchains reaching $2.4 billion, followed by tokenized commodities with $1 billion (source).

This integration extends beyond stocks and bonds, as blockchain technology has the potential to revolutionize various financial instruments. Tokenization can be applied to a wide range of assets, including real estate, commodities, and even traditional financial products. The benefits of blockchain integration, such as reduced transaction costs, enhanced transparency, and improved liquidity, make it an attractive option for virtually any financial product.

Finoa offers an API that allows institutions to seamlessly integrate digital asset custody data into the third-party tools they already rely on. This enables businesses to access Finoa’s bank-level security and custody services without disrupting their existing workflows or interfaces. By providing custody data within familiar platforms, the API simplifies reporting, supports compliance efforts, and ensures a smooth user experience. Institutions can harness secure crypto-asset management while continuing to work within the tools and environments they know best.

Get in touch

Family offices seeking direct exposure to digital assets, staking opportunities, or the emerging wave of tokenized assets will find Finoa uniquely positioned to help them navigate the future of finance. As a trusted digital asset custodian, Finoa offers a comprehensive suite of services designed specifically for institutional investors. These include industry-leading token support, staking through our subsidiary Finoa Consensus Service (FCS), and seamless trading facilitated via a German-regulated OTC trading partner—all within the secure and compliant framework of Germany’s stringent crypto regulations.

Finoa's robust infrastructure, combined with our deep expertise in institutional-grade custody and digital asset management, enables family offices to confidently participate in this rapidly evolving market. We are committed to providing tailored solutions that empower family offices to diversify their portfolios and capitalize on the full potential of blockchain technology. Let us help you explore and execute your digital asset investment strategy with security, reliability, and strategic insight.