A guide to liquid staking

The Proof of Stake consensus mechanism secures the vast majority of modern blockchains, as we’ve explained in a previous blog post, Proof of Stake disincentivizes an attack on the network by requiring control of the majority of tokens to control the blockchain. New blockchain transactions are verified by putting tokens “at stake”, which can be taken away (“slashed”) in the event of fraudulent behavior. This is in contrast to the traditional Proof of Work consensus mechanism whereby an attack is disincentivized by requiring a majority of the computing power. In both Proof of Stake and Proof of Work, the disincentive is an economic one.

With Proof of Stake, a token holder can lock up tokens and use their weight to verify the authenticity of transactions. The owner of the tokens receives a return roughly similar to that of a bond. Unlike a bond, however, while the tokens are staked they cannot be transacted, traded, or used as collateral – they are illiquid.

What is liquid staking and how does it work?

Liquid staking solves this illiquidity problem. A liquid staking provider takes token deposits, stakes those tokens, and gives the depositor a receipt that is redeemable for the staked tokens. The receipt is a representation of those staked tokens that can be traded or used as collateral elsewhere. For this reason, liquid staking tokens are sometimes referred to as liquid staking derivatives.

Users of the liquid staking provider Lido deposit their tokens, which are staked to multiple validators. Lido gives the user a liquid staking token in return.

Advantages to liquid staking

The most obvious advantage to liquid staking is the immediate liquidity. Exactly how large of an advantage this is depends on the blockchain and liquid staking token in question. On the Polkadot blockchain for example, stakers wishing to unstake are subject to a so-called “unbonding period” of 28 days. If a staker wished to react to a sudden market movement, they would be better off selling a liquid staking token than waiting to unstake.

The immediate liquidity of a liquid staking token comes at the price of reduced overall liquidity: Ethereum’s native token ETH trades between $10b-$30b of volume per day, while the largest liquid staking token stETH trades less than $5m-$20m per day. Large market participants must carefully consider whether the size of their position is appropriate for the liquid staking token they will receive.

An additional advantage of liquid staking is the “composability” of the yield strategies that it enables. Liquid staking tokens can be used as collateral on centralized or decentralized exchanges or lending pools, for example: the staker can lend out their liquid staking token and receive the loan’s interest on top of the staking yield. This generally applies to all of the yield strategies in decentralized finance (DeFi). On centralized platforms, staked tokens may be used as collateral for loans, margin and derivative trading, depending on the platform.

There are also advantages to liquid staking on a technical level: when staking the usual way, a token holder would delegate their stake to a single validator, who keeps a share of the reward in return for running the required infrastructure. Note that the validator usually does not need to take custody of the tokens, the tokens are merely delegated to the validator.

The risk typically associated with staking is that tokens can be taken away (“slashed”) by the blockchain if the validator misconfigures their hardware or has significant downtime. When staking into a liquid staking pool, though, the pool’s tokens are staked across many validators and slashing penalties are usually socialized across the pool. This decreases the risk of significant loss from slashing. Stakers may also consider whether staking with a certain liquid staking provider earns a higher yield due to the collection of Miner Extractible Value (MEV).

Liquid staking platforms and supported tokens

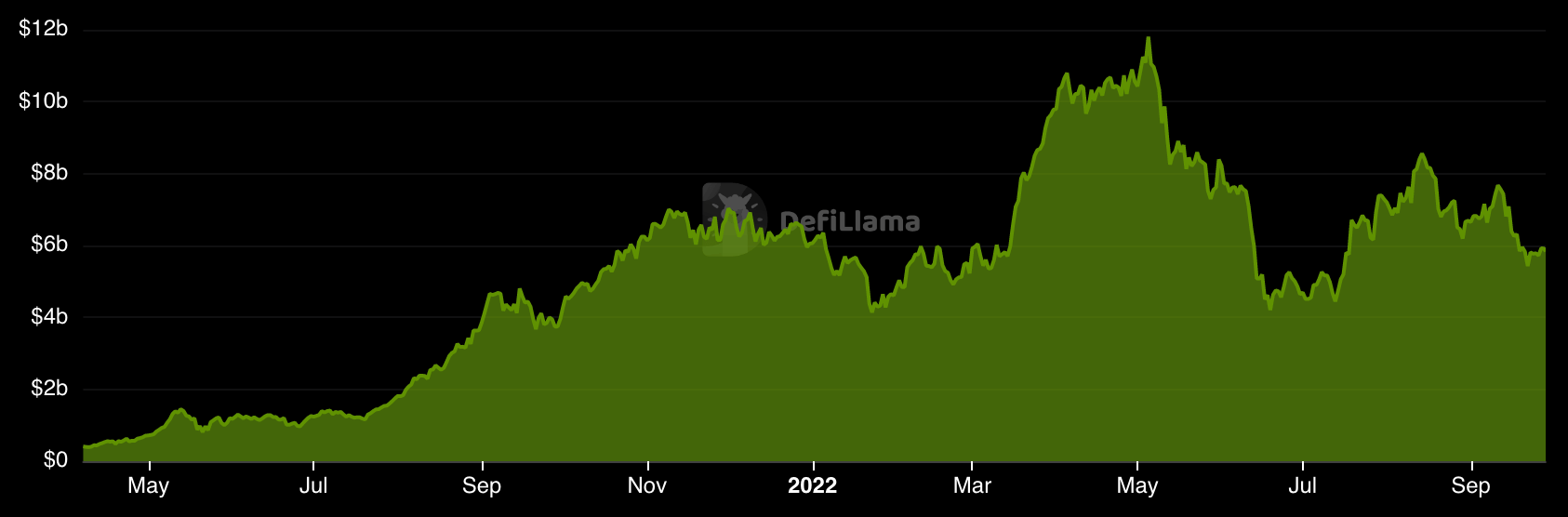

According to DefiLlama, there are about $8.5b in liquid staking protocols across many blockchains including. The following is a non-exhaustive list of some of the most popular liquid staking tokens:

- Ethereum

- Polygon

- Solana

- Binance Smart Chain

- Avalanche

- Fantom

- Polkadot

- Acala

- NEAR

- Hedera.

With $6.5b of Total Value Locked (TVL), Lido Finance makes up more than 75% of the liquid staking market, almost all of which comes from their Ethereum pool. Stakewise, the 7th largest staking provider, has entered into a partnership with Finoa to build liquid staking infrastructure on Ethereum and Gnosis.

Lido Finance makes up over 75% of the liquid staking market, largely because of the $5.6b in their Ethereum liquid staking pool.

Ethereum liquid staking

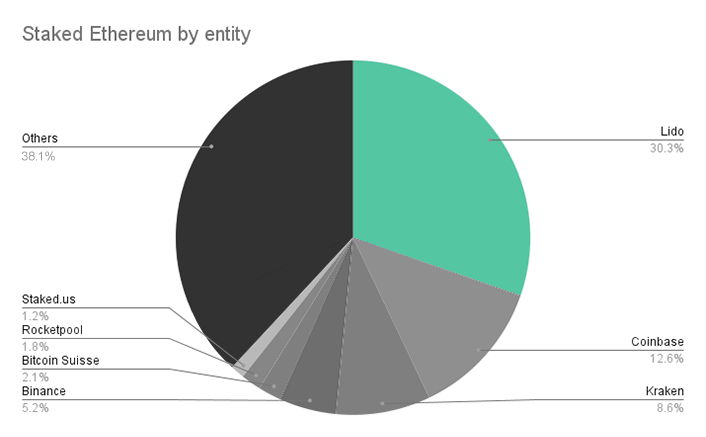

Ethereum is the blockchain with the most value in both staking and liquid staking. Lido Finance makes up the dominant share of Ethereum’s liquid staking. The chart below shows the amount of Ethereum staked to the various liquid staking providers.

Lido was the first liquid staking provider on Ethereum and remains the dominance provider. Source: Dune

Source: beaconcha.in

The rise of liquid staking on Ethereum is largely due to the unique constraints in Ethereum staking functionality. ETH can only be staked in 32ETH increments, and cannot be unstaked until that functionality is implemented in the Shanghai upgrade, which may not be ready before Q3 or Q4 of 2023.

An additional constraint is the inability for ETH stakers to ‘delegate’ to a validator - ETH stakers must either run their own validator or give custody of their assets to a validator in order to stake them. These limitations create significant barriers to entry for Ethereum staking, which are solved by liquid staking pools. Today, just over 10% of the total supply of 123m ETH is staked, as shown in the chart, with liquid staking providers playing an increasingly important role.

While Ethereum stakers had the most to gain from liquid staking, users of other blockchains also benefit from the advantages discussed earlier. Although the focus remains on Ethereum, liquid staking pools are slowly becoming commonplace on other chains as well.

Is liquid staking safe? The risks and opportunities weighed

As discussed earlier, large market participants need to be mindful of the limited liquidity of liquid staking tokens. Since Ethereum has no unstaking mechanism, there is no way for arbitrageurs to provide additional liquidity to the market by taking advantage of a price discount of a liquid staking token.

Understanding the stETH to ETH “peg”

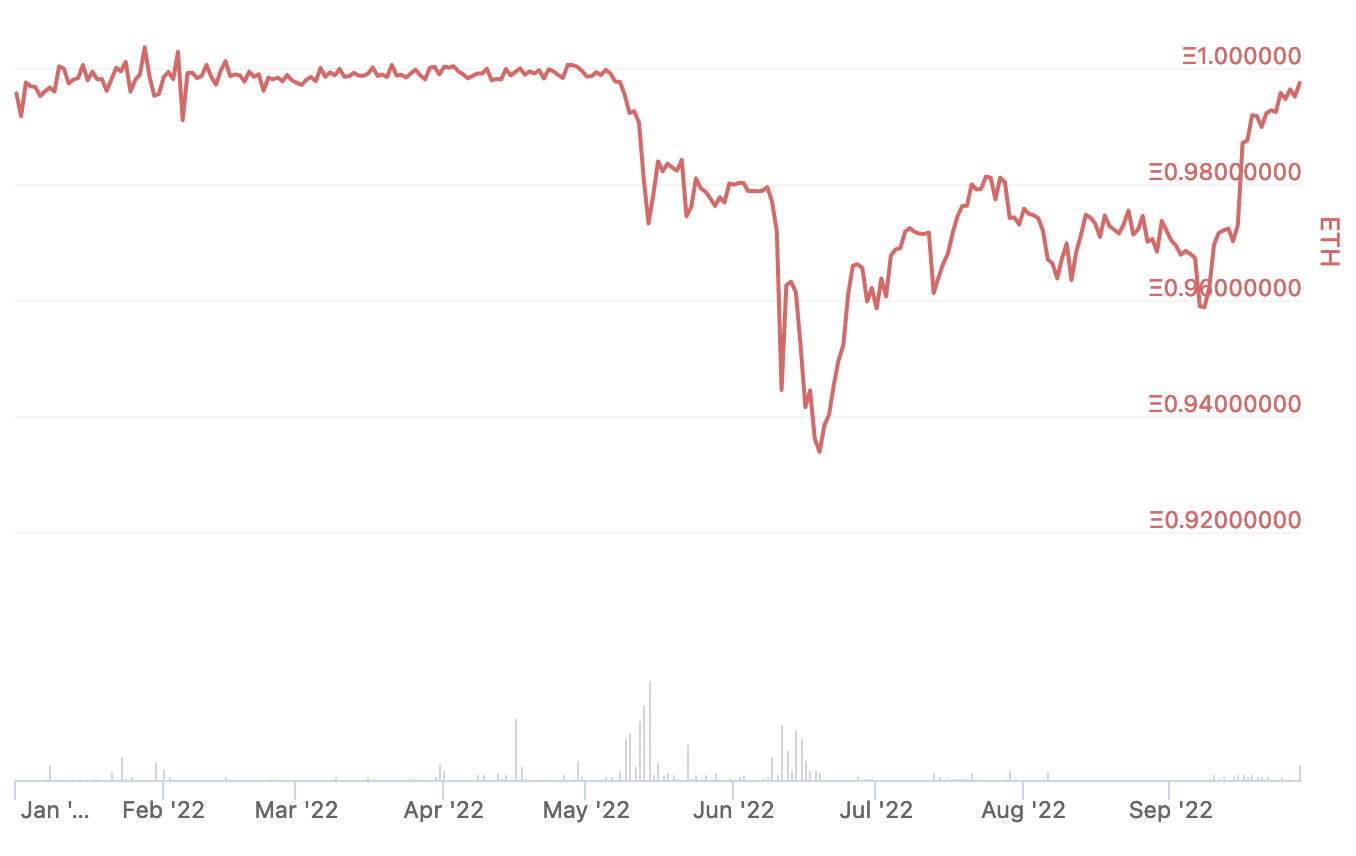

The price of liquid staking tokens is not “pegged” to the price of ETH - they trade freely in the market. As a result, in bearish market regimes or during a rush for liquidity, the price of Ethereum liquid staking tokens begin trading at a discount to Ethereum.

In June of 2022, as overleveraged market participants hurried to sell their stETH, the price of stETH moved down to a 5-7% discount below the price of ETH, as shown in the chart.

This “depegging” from the price of ETH demonstrated the vulnerability of token holders, and the discount remained for many months before recovering in mid-September 2022.

The price of Lido’s stETH (“staked Ethereum”) token fell to a 6% discount in June of 2022, relative to the price of Ethereum. Source: CoinGecko

Lido has supported over $4b of total value locked (TVL) for 12 months. Source: DefiLlama

Centralized vs. decentralized liquid staking

In addition to liquidity concerns, users of liquid staking should consider whether to stake with a centralized or decentralized provider. A centralized provider like an exchange holds custody of the assets, while a decentralized provider like Lido does not require custody but instead requires that tokens are deposited into a smart contract.

The risk here is that the smart contract is hacked or exploited and the “backing” of the liquid staking token is stolen. However, protocols like Lido are some of the most heavily audited in the space, and have successfully supported billions of dollars for many months, as shown in the chart.

Finally, users of liquid staking protocols should consider whether their choice to stake with a dominant protocol like Lido or a large centralized exchange contributes to the centralization of the blockchain, making it less valuable overall.

As shown in the pie chart, over half of all staked Ethereum is staked with Lido, Coinbase, and Kraken, which opens the door to collusion by those parties to alter the chain’s consensus. This led Lido to hold an internal governance vote on whether to self-limit and avoid further growth, but this was voted against by 99.81% of participating LDO tokens. Although stakers are likely to find the best liquidity with dominant liquid staking providers, they should consider whether they are participating in a tragedy of the commons that makes their assets less valuable overall.

Conclusion

Liquid staking brings stakers the benefits of immediate liquidity, composability of staked assets, and distribution of stake across multiple validators. However, the market’s liquidity for liquid staking tokens is limited, and stakers take on custody risk or smart contract risk, depending on their choice between a centralized or decentralized provider.

For Ethereum, the benefits of liquid staking have encouraged more of the supply to become staked, at the possible expense of decentralization. The benefits of liquid staking extend to many blockchains, however, and the growth of liquid staking pools is an ongoing trend.